Introduction:

In the ever-evolving landscape of finance, one term that has gained immense popularity in recent years is cryptocurrency. While the concept of digital currencies has been around for a while, the advent of Bitcoin and subsequent cryptocurrencies has transformed the financial industry. Among the myriad opportunities that have arisen, crypto trading stands out as a lucrative venture for individuals and businesses alike. In this comprehensive guide, we will delve into the intricacies of crypto trading, providing you with a roadmap to establish and thrive in your crypto trading business.

Crypto Trading

Chapter 1: Understanding the Crypto Market

Cryptocurrency, a decentralized form of currency, operates on blockchain technology. To embark on your crypto trading journey, it is crucial to grasp the fundamentals. What exactly is cryptocurrency, and how does the market function? These questions lay the foundation for your venture into the world of digital assets.

Chapter 2: Setting Up Your Crypto Trading Business

A successful crypto trading business begins with careful planning. From choosing the right cryptocurrencies to selecting a reliable exchange and creating a secure wallet, this chapter guides you through the essential steps. We’ll explore the factors influencing your choices and how to navigate the ever-expanding array of digital assets.

Chapter 3: Risk Management Strategies

The volatile nature of cryptocurrency markets demands a meticulous approach to risk management. Diversification, setting stop-loss orders, and staying informed about market trends are critical aspects to safeguard your investments. This chapter provides a comprehensive overview of risk mitigation strategies tailored for crypto trading.

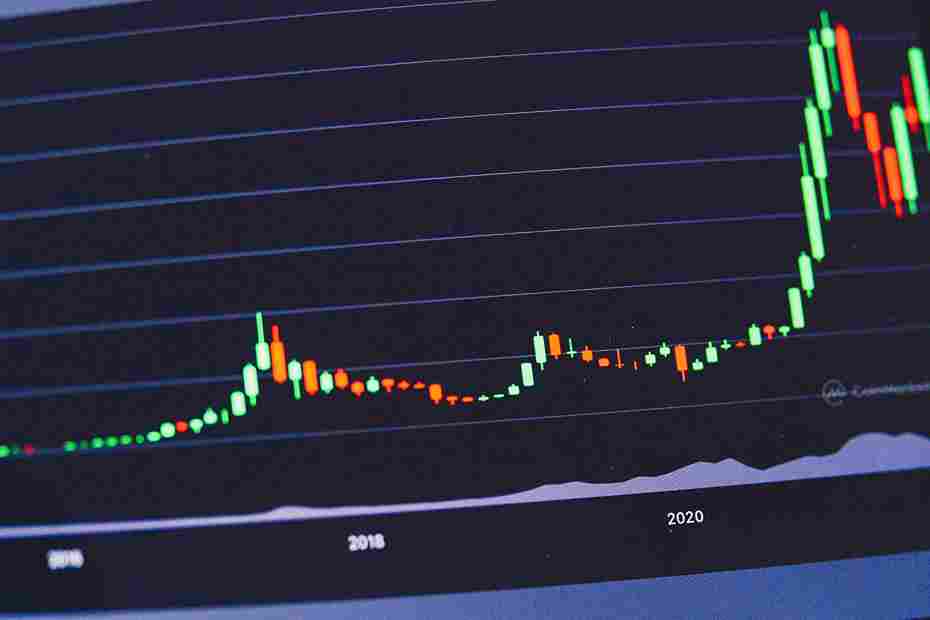

Chapter 4: Technical Analysis for Crypto Trading

For seasoned traders and newcomers alike, understanding technical analysis is paramount. Candlestick patterns, support and resistance levels, and various indicators and oscillators form the basis of informed decision-making. We’ll delve into these tools, equipping you with the knowledge to analyze and predict market movements.

Chapter 5: Developing a Trading Plan

Success in crypto trading is not accidental; it’s the result of a well-thought-out plan. Defining your goals, allocating capital effectively, and adapting to changing market conditions are integral components of a robust trading strategy. This chapter guides you through the process of creating a personalized trading plan.

Chapter 6: Legal and Regulatory Considerations

Navigating the legal landscape is crucial in the world of crypto trading. Compliance with local laws, understanding tax implications, and maintaining accurate financial records are essential to a sustainable and legally sound business. We’ll explore the regulatory considerations that should be at the forefront of your trading operations.

Chapter 7: Implementing Automation with Trading Bots

The integration of technology has introduced trading bots as a powerful tool in the crypto trader’s arsenal. We’ll discuss the pros and cons of utilizing trading bots, how to choose the right one, and the importance of monitoring and adjusting automated strategies.

FAQs:

Q1: Is crypto trading suitable for beginners?

- A: Yes, beginners can start with small investments and gradually learn the ropes. It’s essential to educate yourself and start with a clear understanding of the risks involved.

Q2: How do I choose the best cryptocurrency exchange?

- A: Consider factors such as security features, user interface, fees, available cryptocurrencies, and customer support. Research and read user reviews to make an informed decision.

Q3: What are the key risk management strategies for crypto trading?

- A: Diversification, setting stop-loss orders, and staying informed about market trends are crucial. Never invest more than you can afford to lose.

Q4: How can I stay updated on market trends?

- A: Follow reputable financial news sources, join online communities, and use cryptocurrency market analysis tools. Continuous learning is key to success in crypto trading.

Q5: Are there tax implications for crypto trading?

- A: Yes, tax regulations vary by jurisdiction. Consult with a tax professional to understand your obligations and keep detailed records of your transactions.

Conclusion:

Embarking on a crypto trading business demands a combination of knowledge, strategic planning, and adaptability. By understanding the market, implementing effective risk management strategies, and staying informed, you can position your business for success in the dynamic world of cryptocurrency trading. Remember to stay updated on regulatory changes and continuously refine your trading approach to stay ahead in this rapidly evolving industry. Good luck on your crypto trading journey!