Ulcerative colitis, a chronic inflammatory bowel disease, can pose unique challenges for individuals, impacting their health and daily lives. For businesses, understanding the implications of ulcerative colitis is essential, not only from a human perspective but also in terms of insurance coverage. In this in-depth exploration, we will delve into the intricacies of ulcerative colitis insurance for businesses, covering key considerations, frequently asked questions (FAQs), and the critical importance of comprehensive coverage.

Ulcerative Colitis

Understanding Ulcerative Colitis: A Primer for Businesses

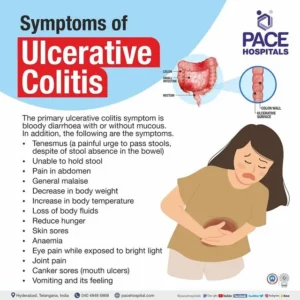

Ulcerative colitis is a type of inflammatory bowel disease characterized by chronic inflammation of the colon and rectum. This condition can manifest through various symptoms, including abdominal pain, diarrhea, fatigue, and, in severe cases, complications that may require medical interventions and surgeries.

For businesses, recognizing the impact of ulcerative colitis on employees is crucial. Individuals with ulcerative colitis may experience frequent medical appointments, potential hospital stays, and periods of disability. As such, businesses need to be well-informed about the condition and the available insurance options to provide adequate support to their workforce.

FAQs on Ulcerative Colitis Insurance for Businesses:

- What is Ulcerative Colitis, and How Does It Affect Employees?

- Why is Insurance Coverage Important for Businesses Regarding Ulcerative Colitis?

- Comprehensive insurance coverage ensures that businesses can support employees facing ulcerative colitis. This includes coverage for medical treatments, prescription medications, and disability benefits, offering financial protection for both the employee and the business.

- What Types of Insurance Policies Should Businesses Consider for Ulcerative Colitis Coverage?

- Businesses should explore health insurance policies that cover ulcerative colitis treatments, including medications, hospital stays, and surgeries. Additionally, disability insurance can provide income replacement for employees who need time off work due to their condition.

- How Can Businesses Support Employees with Ulcerative Colitis in the Workplace?

- Businesses can implement workplace accommodations such as flexible schedules, remote work options, and accessible facilities to support employees with ulcerative colitis. Open communication and a supportive work environment are essential.

- Are There Specific Exclusions in Insurance Policies Related to Ulcerative Colitis?

- It’s crucial for businesses to carefully review insurance policies to identify any specific exclusions related to ulcerative colitis. Some policies may have waiting periods or limitations on coverage for pre-existing conditions.

Navigating Insurance Policies and Considerations:

Businesses must be diligent in selecting and reviewing insurance policies that cater to the unique needs of employees with ulcerative colitis. Health insurance policies should cover a range of treatments, including medications, consultations, diagnostic tests, and surgical interventions. Additionally, disability insurance becomes instrumental in providing financial support to employees during periods of medical leave.

Understanding policy limitations and exclusions is equally vital. Some insurance policies may have waiting periods before coverage begins, while others may exclude certain treatments or pre-existing conditions. Employers must work closely with insurance providers to clarify any ambiguities and ensure that the chosen policies align with the specific needs of their workforce.

The Importance of Workplace Support and Accommodations:

Creating a supportive workplace environment is paramount for employees managing ulcerative colitis. Businesses can implement various accommodations to facilitate a more inclusive atmosphere:

- Flexible Schedules: Providing employees with the flexibility to adjust their work hours can be crucial, especially during periods of medical treatment or when dealing with symptoms.

- Remote Work Options: Allowing remote work provides employees with the opportunity to manage their condition in a comfortable and less stressful environment, reducing the impact of commuting and workplace stressors.

- Accessible Facilities: Ensuring that workplace facilities are accessible and accommodating to the needs of individuals with ulcerative colitis contributes to a more inclusive and considerate work environment.

Conclusion: Ensuring Comprehensive Ulcerative Colitis Insurance Coverage for Business Success

In conclusion, businesses must prioritize understanding and addressing the unique challenges presented by ulcerative colitis. By providing comprehensive insurance coverage, employers not only support the well-being of their employees but also contribute to a positive and inclusive workplace culture. Stay informed, review insurance policies regularly, and proactively engage with employees to create a work environment that fosters understanding and support for those managing ulcerative colitis.

A well-crafted insurance strategy is not only a financial investment but also an investment in the health and productivity of your workforce. Prioritize the well-being of your employees, and your business will reap the benefits of a healthier and more engaged team. Navigating ulcerative colitis insurance may seem complex, but with the right information and a commitment to employee welfare, businesses can ensure a resilient and supportive workplace for all.